In This Article

We rate American Dream Auto Protect 4.2 stars overall in this review, covering the company’s plans, costs, and reputation.

- American Dream Auto Protect offers customizable extended auto warranty plans for new and used vehicles across the US.

- The company is a direct warranty provider, not a broker, so you don’t have to work with a middleman for claims service.

- Whichever plan you choose comes with roadside assistance, rental car coverage, and trip interruption.

If you’re looking for an extended car warranty you can take to any ASE-certified shop across the country, American Dream Auto Protect is a good option. The company’s plans are designed to fit anyone from commuters to rideshare drivers and high-mileage vehicle owners. In this review, we’ll look at American Dream Auto Protect’s claims, coverage, and reputation to help you decide if it’s right for you.

Our #1 Pick

After reviewing 20 companies, we’ve determined that Endurance is our preferred option for extended car warranties.

- Unlimited Miles for Cars Under 20 Years

- Maintenance Coverage Available

- Salvage or Rebuilt Cars Are Covered

- 24/7 Roadside Assistance

- Direct Administrator of Claims

What Is American Dream Auto Protect?

Is American Dream Auto Protect a Direct Warranty Provider or Broker?

Our American Dream Auto Protect Rating

| Category | Rating |

|---|---|

| Coverage | 4 |

| Cost and Buying Experience | 4.5 |

| Reputation | 3.9 |

| Customer Service | 4.2 |

| Overall Rating | 4.2 |

American Dream Auto Protect Coverage Breakdown

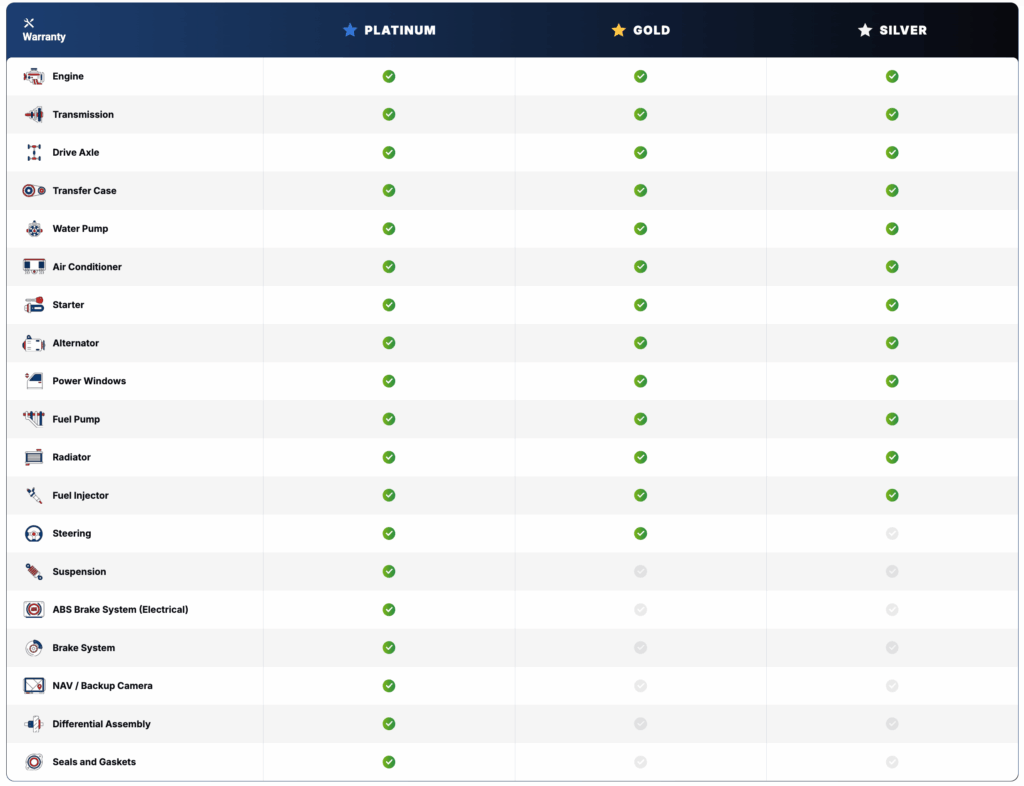

American Dream offers three main plans:

- Platinum: Comprehensive car warranty coverage for things like braking components, suspension systems, steering mechanisms, electrical, air conditioning, engine, transmission, and more

- Gold: Covers most major systems like the engine, transmission, drive axle, alternator, power windows, and fuel pump

- Silver: Affordable coverage for major powertrain systems plus a few others (fuel pump, power windows, and others)

If you want worry-free driving, the Platinum plan provides the highest level of coverage. On the other hand, you can find more affordable mechanical breakdown coverage options with Gold and Silver plans if you want to save money.

Whatever plan you get, American Dream Auto Protect provides direct payment to ASE-certified shops (besides your deductible) for covered repairs. This means you can visit over 200,000 locations nationwide, including dealerships, for coverage.

Be sure you or the mechanic contacts American Dream Auto Protect’s team before doing any work, since the company has to authorize covered repairs.

American Dream Auto Protect Car Warranty Benefits

Besides the coverage for specific breakdowns and repairs, plans include benefits like:

- 24/7 roadside assistance

- Trip interruption coverage

- Rental car reimbursement

These benefits are standard for the most part, but not all companies provide them. It’s nice to have things like roadside assistance when you get stuck on the highway, since it helps with the stressful situation and can lower your out-of-pocket expenses.

What Does American Dream Auto Protect Not Cover?

Like most aftermarket auto warranty providers, American Dream excludes:

- Wear-and-tear items (tires, brakes, wiper blades)

- Scheduled maintenance (e.g., oil changes)

- Pre-existing conditions

- Cosmetic damage or bodywork

- Damage from accidents, the environment, or vandalism

- Damage from misuse

- Aftermarket modifications (all covered parts must be factory-installed)

Other Auto Warranty Terms and Conditions

Here are a few more terms and conditions to be aware of with American Dream Auto Protect:

- Plans require a waiting period (the industry standard is 30 days and 1,000 miles, though it can vary by plan)

- Money-back guarantee within 30 days

- Coverage is transferable if you sell the vehicle, in most cases

- You’re required to follow the manufacturer’s service schedule to keep coverage valid

American Dream Auto Protect Cost and Buying Experience

Our team received a quote of $99 per month for a Silver plan for a 2018 Kia Sportage with 110,000 miles from American Dream Auto Protect. Compared to other companies we researched, this rate was more affordable than the average of $130. This makes American Dream Auto Protect a good budget option if you’re looking to save money on a warranty.

Here’s the full information about this quote:

- Vehicle: 2018 Kia Sportage with 110,000 miles

- Term: Month-to-month up to 200,000 miles

- Price: $99 per month until canceled or 200,000 miles

- Deductible: $100

Note that a $99 monthly cost works out to $1,188 per year. This was also lower than the industry average cost of $1,293 per year of coverage.

Also, the quote process was very fast, and we received a call back in less than a minute after completing the form.

What Factors Affect Warranty Costs?

Prices vary based on:

- Vehicle make, model, and mileage

- Level of coverage

- Usage (rideshare or commercial use may require an endorsement)

- Deductible (a higher deductible can lower the overall cost and vice versa)

In general, rates for the same plan will be higher for older vehicles with more miles.

American Dream Auto Protect Claims

You can file a claim over the phone during business hours or have your mechanic call American Dream Auto Protect directly. Since the company handles claims itself, you can usually expect good service times to have a repair approved and paid for.

Who Accepts American Dream Auto Protect Warranties?

American Dream Auto Protect Pros and Cons

| Pros | Cons |

|---|---|

| Customizable warranty coverage | Not available in every state |

| Fast quotes after completing an online form | No sample contracts available online without sign-up |

| ASE-certified mechanic coverage nationwide | No instant online quote option (must receive call) |

| 24/7 roadside assistance, trip interruption, rental car coverage | Not as many plans as some competitors |

| More affordable than many other companies |

American Dream Auto Protect Reputation

American Dream Auto Protect has a high 4.2-star rating on Trustpilot from over 2,100 customers. This shows most customers have a positive experience with the company. The provider has also responded to over 84% of negative reviews to help resolve issues.

American Dream Auto Protect Customer Reviews

Positive American Dream Auto Protect reviews often highlight the fast and easy quote process, with many users mentioning clear communication from sales representatives. Several reviewers also report that claims were approved quickly and paid directly to repair shops, which made for a smooth, stress-free experience.

Negative reviews are less frequent but usually involve specific repairs being denied because of exclusions listed in the contract. This isn’t uncommon in the extended auto warranty industry, as no plan covers every component. This is also one reason why it’s important to read the fine print thoroughly and understand what’s covered.

American Dream Auto Protect vs. Competitors

Compared to other companies on the market, American Dream Auto Protect offers lower rates but doesn’t have as many plans or as high mileage limits as some competitors. That said, 200,000 miles is plenty for most people.

| Maximum Mileage | Sample Monthly Cost | Number of Plans | Added Benefits | |

|---|---|---|---|---|

| Endurance | Unlimited | $138 | 6 | Roadside assistance, rental coverage, trip interruption plus Elite benefits |

| Toco | 250,000 | $79 | 4 | Roadside assistance, rental coverage, trip interruption |

| Everything Breaks | 250,000 | $108 | 5 | Roadside assistance, rental coverage, trip interruption |

| autopom! | 150,000 | $110 | 3 | Roadside assistance, rental coverage, trip interruption |

| Olive | 185,000 | $120 | 3 | Towing, rental car coverage |

| American Dream Auto Protect | 200,000 | $99 | 3 | Roadside assistance, rental coverage, trip interruption |

Who Should Buy an American Dream Auto Protect?

Choose American Dream Auto Protect if you:

- Drive a used or high-mileage vehicle

- Want peace of mind on long trips

- Prefer month-to-month payment plans

Conclusion: Is American Dream Auto Protect Worth It?

American Dream Auto Protect Review FAQs

How We Rank Extended Warranty Providers

We take a methodical approach to rating warranty companies. Here’s what that includes:

- Coverage: We consider things like the number of plans, mileage limit, maintenance coverage options, and added benefits to score companies in this area.

- Cost and buying experience: We get quotes from providers and pay attention to the experience with customer service. We also consider a company’s transparency during the buying process through sample contracts and clear coverage descriptions.

- Reputation: This category includes a company’s longevity plus its rating on the BBB and whether or not it has BBB accreditation.

- Customer service: To rate customer service, we look at BBB customer ratings plus Trustpilot scores. We also note whether the company is a direct warranty provider.

Brogan Woodburn

Advertiser Disclosure: Consumer Review Center might earn compensation from the companies featured on this page. This compensation could affect the placement, order, and visibility of products, but it does not affect the recommendations made by the editorial team. Not every company, product, or offer has been reviewed.

Related Resources

Endurance Car Warranty

Endurance is the nation’s leading provider of extended auto warranties. They administer their own contracts and have clearly defined coverage options. There is never any secret as to what coverage you have purchased.

American Dream Auto Protect

We rate American Dream Auto Protect 4.2 stars overall in this review, covering the company’s plans, costs, and reputation.

Fair Warranty Review

New extended car warranty company Fair partners with online car retailers and financial institutions to provide affordable plans with quick claims service.

Autopom! Warranty Review

Written by Industry Expert How we rank extended warranty providers Advertiser Disclosure In This Article Read our autopom! review to see if the warranty company’s