American Home Shield

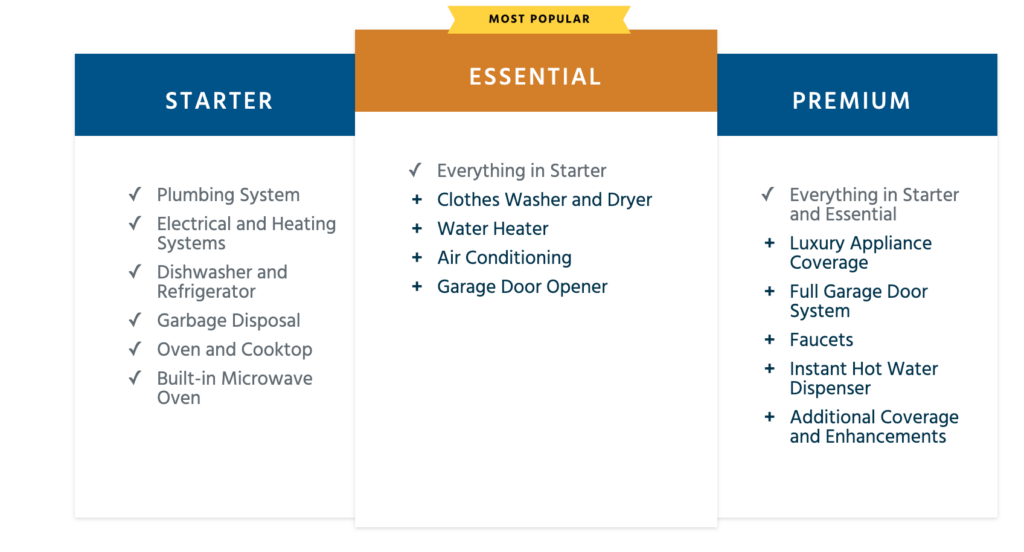

Generous coverage, transparent terms, and an incredibly supportive team put American Home Shield (AHS) at the top of the list. AHS pays up to $3,000 per item for most appliances and systems. That’s way more than most providers are willing to pay.