Liberty Home Guard

Written by Industry Expert How we rank extended warranty providers Advertiser Disclosure In This Article Liberty Home Guard can cover up to 15 appliances and

A home warranty can come in handy when your refrigerator quits working and you don’t have the time to find a service provider on your own. However, it’s important to find the right provider, since some companies have better reputations than others. We compared home warranty companies on trustworthiness, coverage, cost, flexibility, and customer experience to help you find the right option. Read on to learn about our top picks.

After reviewing 20 companies, we’ve determined that Liberty Home Guard is our preferred option for home warranties.

Compare our picks for the best home warranty providers below.

| Company | Covered Items in Best Plan | Per Claim Fee | Monthly Cost Range |

|---|---|---|---|

| Liberty Home Guard | 15 | $50 to $150 | $49.99 to $59.99 |

| Old Republic Home Protection | 25 | $100 or $125 | $55 to $80 |

| First American Home Warranty | 19 | $100 or $125 | $61 to $96 |

| Choice Home Warranty | 18 | $100 | $46.83 to $54.75 |

| AFC Home Warranty | 22 | $75 to $125 | $37.75 to $69.50 |

Before we jump in, here are a few things all home warranties on our list (and most in the industry) have in common:

Liberty Home Guard is our top pick for its strong reputation and a good range of home warranty plans.

| Pros | Cons |

|---|---|

| High ratings on the BBB, Google, and Trustpilot | Not the cheapest coverage out of the leading providers |

| You can use your own technician in some situations | The $2,000 limit per repair on most covered items is lower than limits from other companies |

| Plans are easy to understand and offer multiple upgrade options |

Liberty Home Guard has the highest customer ratings out of our top picks—its customers rate it:

Liberty Home Guard is also one of the only companies that allows you to choose a contractor (that the company must authorize).

| Research Category | Liberty Home Guard Rating |

|---|---|

| Trustworthiness | 4.5 |

| Coverage | 4.6 |

| Pricing | 4.3 |

| Service flexibility | 4.6 |

| Customer experience | 4.7 |

| Overall rating | 4.6 |

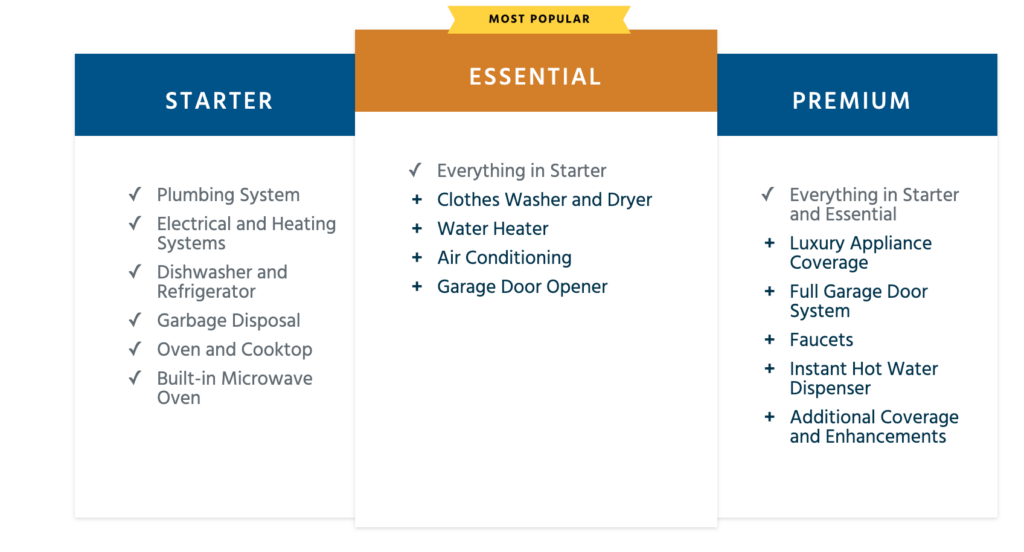

Liberty Home Guard offers three plans with plenty of upgrades you can add to any plan.

Liberty Home Guard will pay up to $2,000 per covered item but up to $500 for plumbing, electrical, and add-on options (and $250 within the first 90 days after the effective date).

You can choose your own technician as long as they contact Liberty Home Guard and get authorization before doing any work.

If the same part fails within 60 days after a Liberty Home Guard technician fixes it, you won’t pay another per-claim fee.

Here are the quotes we received from Liberty Home Guard:

Compared to other options in the market, these costs are about average. Liberty Home Guard doesn’t stand out as the cheapest or most expensive option.

What’s the fee per claim? You’ll pay between $50 and $150 per repair depending on the option you select.

Liberty Home Guard stands out for high ratings on multiple platforms. It has a 4.3-star rating on the BBB, a 4.7-star rating on Google, and a 4.8-star rating on Trustpilot. Most other providers have at least one or two ratings below 4 stars.

That said, Liberty Home Guard isn’t rated on the BBB at this time. The company is working with the BBB to address previous complaints about long wait times for service.

Can you cancel a plan? You can cancel at any time. If you cancel before 30 days, you’ll get a full refund minus a $50 fee. Canceling after that point gives you a prorated refund based on time and claims paid minus the fee.

Learn more: Liberty Home Guard Review

Having been founded in 1974, Old Republic has a strong industry reputation and offers good coverage limits for different systems.

| Pros | Cons |

|---|---|

| High coverage limits for appliances and systems | Higher monthly cost than some competitors |

| Strong rating on the BBB and Trustpilot | Only available in 25 states |

| No annual coverage limit for electrical repairs | Not as many add-ons as other companies |

| Research Category | Old Republic Rating |

|---|---|

| Trustworthiness | 4.8 |

| Coverage | 4.7 |

| Pricing | 3.5 |

| Service flexibility | 3.0 |

| Customer experience | 4.0 |

| Overall rating | 4.5 |

Old Republic offers three plans and covers many items in its Basic plan.

Old Republic pays up to $3,500 per year for appliances or $7,000 with the Elite plan. It covers the A/C and heating/ductwork up to $6,500 per year and doesn’t have a limit for electrical repair coverage. Optional upgrades are limited to $500 to $3,500 each depending on the system.

If Old Republic doesn’t have a technician in their network for a particular job, you can call one yourself. The default is for Old Republic to choose the technician, though.

You don’t have to pay another fee if the same part breaks down within 30 days of repair.

Here are the quotes we received from Old Republic Home Protection:

Old Republic Home Protection is a bit more expensive than average compared to other options on the market. That said, it offers higher coverage limits than some other companies, too.

What’s the fee per claim? You can choose to pay $100 or $125 per claim visit. The prices above include a $100 fee, and choosing a $125 fee lowers the monthly cost by $5.

Old Republic has a 3.4-star rating from customers on the BBB, a 4-star rating on Trustpilot, and a 3.8-star rating on Google. Many customers on Trustpilot say Old Republic covered repairs without issues.

Can you cancel a plan? You can cancel your plan for a $50 fee. This fee is required whether you cancel before or after 30 days.

Learn more: Old Republic Home Protection Review

First American Home Warranty’s Premium plan covers appliances up to $7,000 and offers unlimited annual coverage for the washer/dryer and water heater making it a great choice for higher-end homes.

| Pros | Cons |

|---|---|

| Covers repairs through concrete, which some companies don’t cover | Higher-than-average monthly costs |

| High annual limits of $3,500 or $7,000 for appliances depending on the plan | Doesn’t offer as many coverage or upgrade options as some competitors |

| Unlimited annual coverage for water heater and washer/dryer |

First American Home Warranty has a 40-year history and solid industry reputation. We think it stands out for having high coverage limits—the starting limit for appliances is $3,500, while you can get $7,000 with the Premium plan. This means you shouldn’t have to worry about coverage maxing out for appliances like your dishwasher or oven and range.

| Research Category | First American Home Warranty Rating |

|---|---|

| Trustworthiness | 4.7 |

| Coverage | 4.9 |

| Pricing | 3.3 |

| Service flexibility | 3.3 |

| Customer experience | 3.5 |

| Overall rating | 4.4 |

Here’s what you can find from First American:

Note that the Essential plan covers more components within certain systems than the Starter plan. For example, only the Essential plan covers faucets, shower heads, and hose bibbs in the plumbing system.

First American Home Warranty covers $3,500 per year for appliances (the Premium plan increases the limit to $7,000 or unlimited for some appliances). The Starter plan doesn’t cover systems beneath concrete, while the Essential plan covers $500 and the Premium plan covers $1,000 for repair behind concrete.

First American has the sole right to choose a service provider, though it might ask you to choose one if none is available in First American’s network.

First American guarantees repairs for 30 days. If the same component fails within this time, you won’t pay another fee.

Our quote data shows you can find the following prices from First American:

As with Old Republic, First American’s rates are a bit higher than competitors. We found multiple companies offered starter plans of around $50 per month or below. You do get good coverage limits for the price, however.

What’s the fee per claim? You can choose a $100 or $125 fee per claim.

First American has a 4.1-star rating on Trustpilot. However, the company has a 2.8-star rating on Google and a 1.83-star rating from customers on the BBB. Looking at reviews on Trustpilot, one customer noted there’s a difference between what they and First American consider to be an emergency worth expediting. Another customer said they had no problem with First American but the service provider they got paired with wasn’t professional.

Can you cancel a plan? You can cancel within 30 days for a full refund. After that, you’ll get a prorated refund minus a $50 fee.

Learn more: First American Home Warranty Review

Choice Home Warranty keeps things basic with two plans, a few add-ons, and low prices.

| Pros | Cons |

|---|---|

| Low monthly costs for the industry | Not as many plans as competitors |

| Basic plan covers a good range of systems and appliances | Lower coverage limits for the industry |

| Available nationwide (except WA) |

| Research Category | Choice Home Warranty Rating |

|---|---|

| Trustworthiness | 4.5 |

| Coverage | 4.2 |

| Pricing | 4.5 |

| Service flexibility | 3.8 |

| Customer experience | 3.9 |

| Overall rating | 4.2 |

Choice Home Warranty offers two main choices plus some upgrades.

Choice Home Warranty covers up to $3,000 per year for the repair or replacement of most covered items. The limit is $250 or $500 for many add-ons like septic tank systems or well pumps

No. Choice Home Warranty assigns a service provider to your claim.

If the work your service provider fails within 30 days, Choice Home Warranty will correct the problem without another fee.

Choice Home Warranty costs $46.83 per month for the Basic plan or $54.75 per month for the Total plan. These prices make it one of the more affordable companies in the industry. Depending on when you shop, you might also find some sales or discounts from the company.

What’s the fee per claim? Choice Home Warranty charges a standard fee of $100 per claim. You’ll pay this directly to the technician.

Choice Home Warranty has ratings of 3.8 stars on Google and 3.7 stars on Trustpilot. However, it has a 1.0-star rating on the BBB. One issue we noticed is Choice Home Warranty sometimes offers customers too little money to replace an appliance. Other reviews say service can be hit-and-miss depending on the contractor you get. That said, the majority of reviews are positive.

Can you cancel a plan? You can cancel a Choice Home Warranty within 30 days for a full refund. After that, you’ll get a prorated refund minus a $50 fee.

Learn more: Choice Home Warranty Review

AFC Home Warranty offers flexible service options and a repair guarantee of up to three years.

| Pros | Cons |

|---|---|

| Long repair guarantee | Doesn’t cover the cost to get through concrete |

| Freedom to choose your own repair technician | $500 limit for electrical system repairs per contract term |

| Wide variety of plan options |

AFC makes it on our list of best home warranty companies because it has the longest repair guarantee in the business. This means you don’t have to worry about paying a fee for the same part failing within a contract term. AFC also lets you choose your own technician, which is different from many other companies.

| Research Category | AFC Home Warranty Rating |

|---|---|

| Trustworthiness | 4.1 |

| Coverage | 4.7 |

| Pricing | 4.4 |

| Service flexibility | 4.5 |

| Customer experience | 3.8 |

| Overall rating | 4.2 |

AFC Home Warranty’s four plans offer a good range of coverage options.

AFC Home Warranty will pay up to $3,000 for repair or replacement per item per contract term for most appliances and systems. Some items have lower limits, like $500 for a built-in microwave and $500 for the electrical system. AFC has a total aggregate limit of $50,000 per contract term.

Yes, AFC allows you to call your own technician as long as they’re licensed, bonded, and insured. AFC has to authorize the repair before the technician does any work.

AFC Home Warranty guarantees repairs for the life of the contract term. Terms vary from one to three years, so the guarantee could last up to three years. This is the longest repair guarantee in the industry.

Below are quotes we received from AFC Home Warranty. Note the absence of the Silver plan. While the company lists Silver as a coverage option, our quote only included the three higher plans.

What’s the fee per claim? You can choose a $75 or $125 fee per claim. The prices above include a $125 fee. Choosing a $75 fee increases them by about $6 to $7 per month.

In our review, we found customer service was the weakest point of AFC Home Warranty. The company has the following ratings from customers:

On average, most customers are satisfied, but some express complaints. Some reviewers on Trustpilot said the service was slow and they had to speak with multiple AFC representatives to get work done. Others thought the cash values they were offered for older appliances (instead of repair) were too low.

Can you cancel a plan? You can cancel within 30 days for a full refund. After that, you’ll get a prorated refund minus claims paid and a $75 cancellation fee.

Learn more: AFC Home Warranty Review

Home warranty companies offer service contracts, not insurance or manufacturer warranties. These contracts cover the repair or replacement of appliances and systems that break down from normal wear and tear.

Home warranty providers work with a network of service technicians to fix issues according to your contract. The warranty doesn’t employ technicians, and the customer service you receive can depend on the individual technician assigned to your claim.

Most companies reserve the right to choose the technician. You might get to call your own contractor if the company doesn’t have relationships with contractors in your area. You’ll pay a fee to the technician directly for each claim.

Home service contracts include sections on what parts and situations are excluded. It’s important to read this thoroughly. Home warranties don’t cover damage from outside elements, water damage, accidents, fires, power surges, or misuse. They also don’t cover upgrades to your appliances or systems.

Repairs can be made with non-original parts including refurbished or rebuilt parts in some cases. Warranty companies don’t guarantee a match in size or finish when replacing an appliance.

Warranty companies can ask to see maintenance records and deny a repair if you haven’t maintained a system. Companies usually prefer to repair an item unless it absolutely has to be replaced, according to our research.

Besides exclusions, it’s super important to understand the limits of liability. Companies limit coverage to an amount per year and per item type. For example, a $3,000 limit on appliances means the company will pay up to that amount to repair or replace each appliance listed in one year.

The limit is aggregate, so all repairs of the same system count toward it each year. If a refrigerator has a $500 repair followed by a $1,000 repair, it has had $1,500 in repairs toward the aggregate limit that year.

Obviously, the higher the limit, the better the coverage. Liability limits for appliances and systems usually range from $2,000 to $3,500 on the low end and $5,000 to $7,000 on the high end. Consider what your systems are worth and how much repairs cost in your area to decide the right level of coverage.

It’s a red flag if the company won’t pay over $1,000 for major appliances and systems in a year. However, limits can be much lower for some things, especially add-on options like pools and well pumps. These usually have limits in the $250 to $500 range.

Our quote data shows the average basic home warranty plan costs $42.86 per month while the most comprehensive plan costs $63.71. These averages take into account quotes from 20 popular providers. We also found the most common options for claim fees are $75, $100, and $125.

You might find discounts for first-time buyers or military members from different companies. Also, most companies offer annual payment options about 10% to 20% cheaper than monthly payments over a year.

Finding a reliable home warranty can be tough since many companies don’t have great reputations for coverage. Here are a few things to increase your chances:

Unfortunately, some companies charge cancellation fees even on day one. So get your hands on a sample contract before buying. If the company won’t offer one, move on.

| Warranty Company | Our Rating |

|---|---|

| Liberty Home Guard | 4.6 |

| Old Republic | 4.5 |

| First American | 4.4 |

| Choice Home Warranty | 4.2 |

| AFC Home Warranty | 4.2 |

| American Home Shield | 4.2 |

| Elite Home Warranty | 4.2 |

| Home Warranty Inc. | 4.1 |

| 2-10 Home Warranty | 4 |

| America’s Preferred Home Warranty | 4 |

| Cinch | 4 |

| Select Home Warranty | 3.7 |

| Everything Breaks | 3.7 |

| First Premier | 3.6 |

| ARW Home | 3.6 |

| Fidelity National | 3.5 |

| Home Warranty of America | 3.2 |

| HSA | 3.1 |

| The Home Service Club | 2.9 |

| ServicePlus | 2.9 |

After reviewing 20 companies, we’ve determined that Liberty Home Guard is our preferred option for home warranties.

Our recommendation for the best home warranty is Liberty Home Guard. The company has high ratings from customers and offers three plans, including one that covers just appliances or one that covers just systems like HVAC.

It depends on how old your HVAC is. If the HVAC is old enough, most home warranties will provide a cash payment to cover a similar model replacement, though the value will be lower and based on wholesale prices.

Yes, the A/C compressor is usually included in a home warranty as long as the warranty covers the air conditioning system as a whole.

We’ve thoroughly reviewed 20 major home warranty companies on the market to help homeowners decide which ones are best. Our methodology includes the following categories.

Advertiser Disclosure: Consumer Review Center might earn compensation from the companies featured on this page. This compensation could affect the placement, order, and visibility of products, but it does not affect the recommendations made by the editorial team. Not every company, product, or offer has been reviewed.

Written by Industry Expert How we rank extended warranty providers Advertiser Disclosure In This Article Liberty Home Guard can cover up to 15 appliances and

Companies displayed may pay us to be Verified, when you click a link, call a number or fill a form on our site. Our content is meant solely for general information. Before making any investment decisions, it's crucial to conduct your own analysis considering your personal situation and seek advice from your financial, investment, tax, and legal advisors.

2026 © Consumer Review Center, LLC. All Rights Reserved. The contents of this site may not be republished, reprinted, rewritten or recirculated without written permission.